Adoption of Financial VPPAs

3. The Role of the Treasury Function

Author: Federico Bellanti

May 26, 2025

The Role of Treasury: Data, Models and Professional Judgement

While the IFRS 9 amendment has expanded the scope for hedge accounting eligibility, it has not changed a fundamental principle: the responsibility for determining the hedged volume, assessing hedge effectiveness, and measuring fair value rests with the reporting entity.

For the finance function — and especially Treasury — this means taking ownership of:

- Developing robust and technically defensible models to estimate the expected output of the renewable asset (solar or wind);

- Selecting appropriate sources for the forward price curves (e.g. PUN, Zonal Prices, PEAK/BASE bands);

- Applying fair value methodologies consistent with IFRS 13, even when the derivative is classified as a Level 3 instrument.

Determining the hedged notional

The hedged volume is typically derived from tailored forecast models that integrate technical, meteorological, and contractual data. For solar PV systems, multiyear irradiance simulations (e.g. PVGIS) are used; for wind plants, historical wind data is adjusted for site-specific factors like elevation and turbine height.

The outcome is the construction of an

average monthly production profile in MWh, aligned with:

- The technical characteristics of the system (e.g. capacity, orientation, efficiency);

- The geographical location and relevant climatic conditions;

- Contractual details such as the plant’s expected commissioning date and operational availability (including scheduled maintenance).

In some cases,

adjustment factors may also be applied to account for:

- Conversion or system losses;

- Contractual tolerances;

- Extreme climatic events (e.g. El Niño/La Niña years, prolonged droughts, etc.).

This profile — typically held constant across years but representing a climatically reliable average — must be formally documented and retained as a “rational and reasonably supportable” basis for accounting purposes.

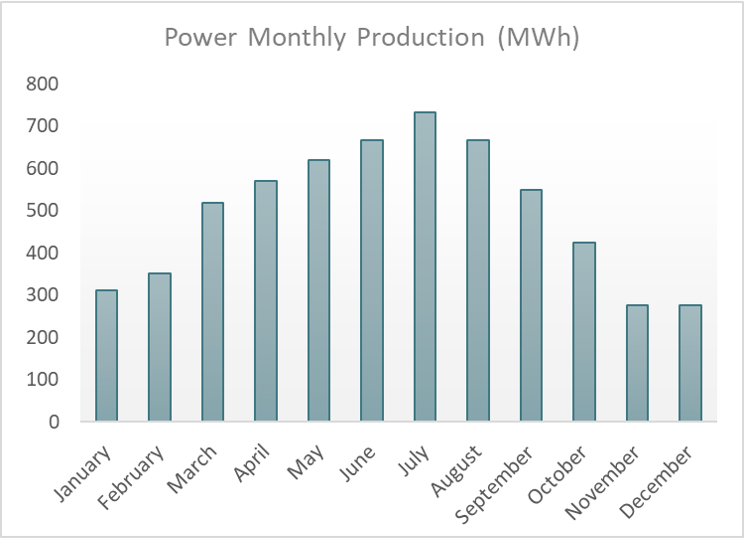

The following chart illustrates an example of a typical monthly output profile for a photovoltaic plant located in Northern Italy.

Importantly, this profile effectively serves as the “operational notional” of the derivative. It forms the basis for estimating future cash flows, calculating mark-to-market values, quantifying potential hedge ineffectiveness, and assessing the alignment of the hedge relationship. Constructing this profile is one of the most critical technical steps in managing a VPPA — but with today’s data and tools, it is entirely achievable.

Mark-to-Market Valuation

Once the hedged profile is established, the derivative’s fair value must be determined. In the absence of a liquid forward market beyond 3–4 years (as is typically the case for power markets in Italy), fair value is estimated using:

- A proprietary forward curve or data sourced from specialized providers;

- A projected price scenario tailored to the relevant zone and time band;

- Discounting of expected cash flows using appropriate curves (e.g. risk-free rates, credit spreads, CVA/DVA adjustments where applicable).

Since these valuations rely on unobservable inputs, they fall within IFRS 13 Level 3, requiring:

- Full documentation of methodology;

- Transparent disclosure of assumptions and data sources;

- Detailed explanation in the notes to the financial statements.

The role of professional judgment

IFRS offers flexibility — but it also demands discipline. Treasury teams, often working alongside Finance, Risk, or ESG functions, must define:

- The methodology for estimating the hedged volume;

- The approach for selecting forward prices and discounting assumptions;

- The frequency of updates;

- The triggers that would require re-documentation or model revision.

All of this must be supported by

formal governance and documentation, suitable for auditor review and internal control processes.

"From a treasury perspective, the economic value of a VPPA emerges from the interaction between energy price volatility, contractual settlement mechanics, and the company’s risk management objectives, rather than from physical energy procurement."

Governance and Policy: a Central Command is Needed

Signing the VPPA and booking the initial fair value is only the beginning. If the contract is accounted for as a derivative and potentially designated in hedge accounting, the company must implement a structured governance model that oversees the full operational and accounting lifecycle of the contract.

Why initial documentation is not enough

Compared to more conventional derivatives, VPPAs have distinctive features:

- Output is variable and weather-dependent;

- Contract terms often extend over 10–20 years;

- Valuation relies on unobservable (Level 3) inputs;

- The contract may directly impact sustainability reporting and ESG disclosures.

The hedge relationship cannot be treated as “set and forget.” It requires continuous oversight, periodic reassessment, and operational embedding.

Updating the Hedging Policy

The company's hedging policy should explicitly address:

- Whether VPPAs qualify as permitted hedging instruments;

- Which risk types are eligible for coverage (e.g. future electricity purchases);

- The procedures for documentation, effectiveness assessment, and ongoing monitoring;

- Thresholds for recognizing and disclosing hedge ineffectiveness.

The policy should also clarify

which internal function is responsible for oversight, and how frequently core inputs (forward curves, production estimates, discount rates) should be validated.

VPPA Integration into Treasury Systems

From an operational perspective, a VPPA structured as a derivative can — and should — be managed within the same infrastructure used for FX, interest rate, and commodity derivatives.

If configured appropriately, the contract can be modeled as a series of non-deliverable forwards (NDFs) or contracts for difference (CfDs) — each with a fixed leg and a floating leg linked to a market benchmark (typically the PMPZ in Italy).

This design allows Treasury teams to leverage:

- Existing systems for fair value reporting and MtM;

- Platforms for confirmations and settlements;

- Existing infrastructure for EMIR compliance, portfolio reconciliations, and dispute resolution;

- The same valuation methodologies and discount curves used across other asset classes.

Integrating VPPAs into existing systems ensures consistency, efficiency, and scalability, and reduces operational risk from fragmented or manual workflows.

The Hidden Side of Regulation: EMIR

When a VPPA qualifies as a derivative under IFRS 9, accounting is only part of the story. Its legal classification also activates mandatory regulatory obligations — in particular, under EMIR (European Market Infrastructure Regulation).

Who is subject to EMIR?

Non-financial firms are subject to EMIR if they trade derivatives, including outside regulated markets. For EMIR purposes, a VPPA qualifying as a Contract for Difference (CfD) on energy prices falls fully within the definition.

Key EMIR obligations

Even for NFC– entities, VPPAs typically trigger the following:

- Trade reporting to an authorized trade repository;

- Timely confirmations within legally defined timeframes;

- Portfolio reconciliation (monthly or quarterly depending on classification);

- Dispute resolution procedures for fair value disagreements;

- Portfolio compression for firms with high derivative volumes.

Compliance: sometimes overlooked, always mandatory

Many companies — particularly those entering their first VPPA — are unaware of the regulatory obligations associated with derivatives. However, once the contract is treated as a derivative, EMIR compliance is mandatory.

Non-compliance can result in:

- Findings by external auditors;

- Legal or operational pushback from counterparties;

- Fines or administrative sanctions from regulators.

A Word on Volatility: Think Twice Before Skipping Hedge Accounting

Some companies — especially when starting out or dealing with low-volume contracts — may consider skipping hedge accounting altogether, opting instead for FVTPL (“trading” treatment) to avoid the burden of documentation and ongoing monitoring.

This is a valid accounting choice — but one that exposes the company to full P&L volatility. In long-dated energy-linked contracts, that volatility can be extreme.

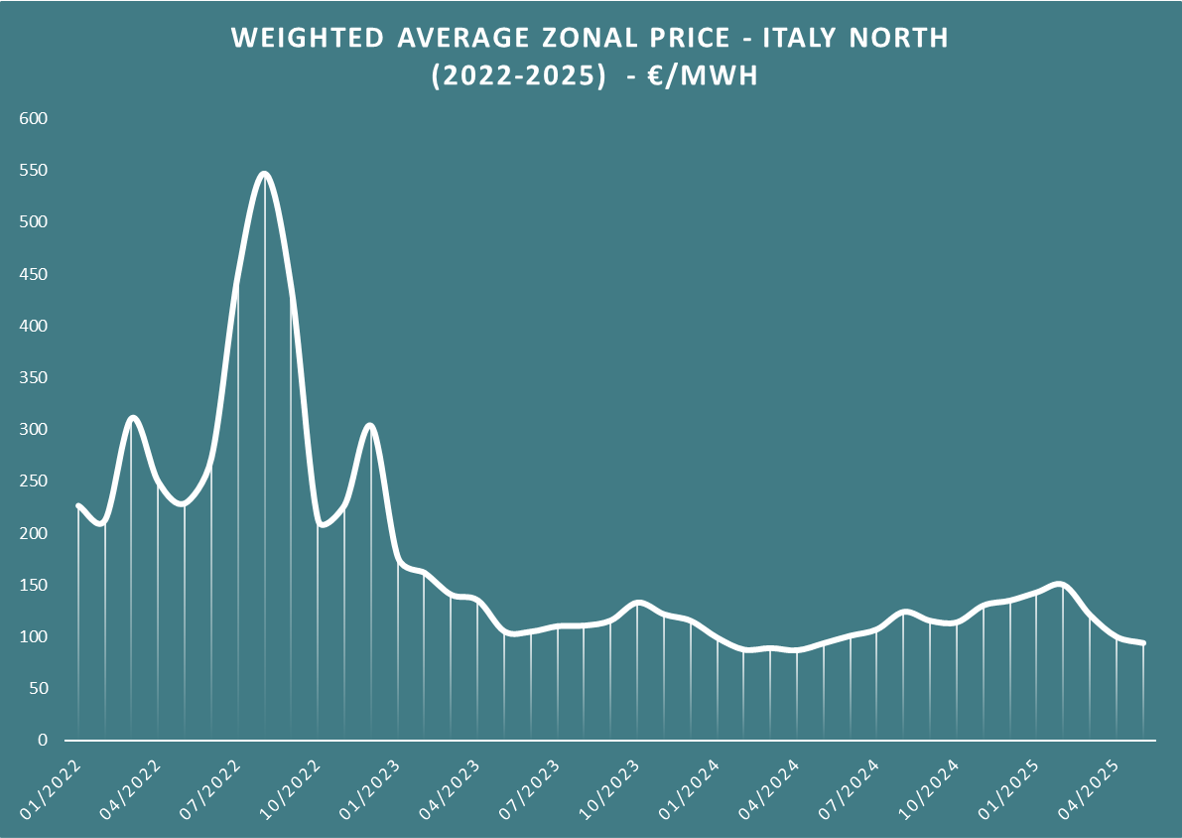

As shown in the chart below (PMPZ – Northern Zone, 2022–2025), price swings of 400% or more have occurred within single years. While some events are clearly exceptional, high volatility is a structural feature of electricity markets.

A 15- or 20-year VPPA — even on a modest monthly volume — may show mark-to-market swings exceeding the entire annual notional, especially in periods of market stress.

For this reason, before dismissing hedge accounting on grounds of complexity, companies should carefully assess the

earnings volatility risk, particularly in the context of investor communications or capital markets exposure.

VPPA Enters the ISDA World: Towards Standardization

In December 2024, ISDA published the Financial Power Purchase Agreement (FPPA) Template, a standardized confirmation format for financial VPPAs.

https://www.isda.org/book/fppa-confirmation-template-with-optional-attachments/

This template:

- Is

compatible with the ISDA Master Agreement

and Schedule;

- Can be

customized to reflect jurisdictional or sector-specific variations;

- Addresses specific VPPA elements such as

renewable certificates,

proxy generation,

plant availability, and performance thresholds.

Its adoption:

- Promotes

legal clarity and transparency in

negotiations;

- Enables full

netting treatment of VPPAs under ISDA protocols;

- Reinforces the case for Treasury ownership of these instruments — alongside IRS, FX, and commodity swaps — using established controls and systems.

As the ISDA FPPA standard gains traction, VPPAs are expected to become increasingly integrated within global derivative infrastructure, improving both market efficiency and internal governance.

Preparing for the Journey: Treasury's Strategic Role

VPPAs — when treated as derivatives — are not simply ESG tools. They are complex financial instruments with material balance sheet, governance, and disclosure implications.

Managing them requires cross-functional expertise across accounting, risk modeling, sustainability, and regulation. In this context, Treasury plays a central coordinating role, bridging industrial objectives with financial responsibility.

The IFRS 9 amendment has opened new paths to represent the economic intent of renewable energy procurement. But the flexibility it provides does not lessen the importance of:

- Correct modeling of hedged exposures;

- Fair value measurement and disclosure under Level 3;

- Regulatory compliance, especially under EMIR;

- And, above all, alignment between financial risk management and operational reality.

The VPPA itself doesn’t create volatility. Volatility arises when the instrument is not governed — operationally, accountably, or procedurally.

This is why VPPAs should never be viewed solely as ESG initiatives or procurement choices. They are part of a broader financial strategy, and Treasury’s leadership — from initial structuring to full lifecycle oversight — is key to ensuring that sustainability goals translate into financial stability.

Considering a VPPA?

Have you signed — or are you about to sign — a VPPA? It’s the right time to define a solid, efficient and defensible accounting and regulatory management model. Studio Bellanti can help you do it, with experience, method and attention to detail.